UK Manufacturing Rebounds in 2025 – What It Means for Industrial Assets

- News

- Uncategorized

22/07/2025

UK Manufacturing Rebounds: What It Means for Industrial Assets

After years of uncertainty, UK manufacturing rebounds back, and some regions are surging ahead with remarkable momentum.

New data from Make UK and BDO reveals that, by the end of 2023, manufacturing output across all UK regions had surpassed pre-pandemic levels. The South West and North West stand out as growth leaders, driven by strong performance in aerospace, defence, and automotive industries. But this isn’t just about growth in output, it signals a shift in asset demand, leasing strategies, and how manufacturers across the country are thinking about their equipment.

At Hickman Shearer, we’re seeing first-hand how these changes are reshaping asset strategy. In this Industry Insights post, we unpack the key developments and what they mean for businesses managing high-value assets across industrial sectors.

Regional Growth Is Reframing Asset Demand

Three regions are driving the UK’s manufacturing momentum:

-

South West: Output up 27% from 2019

-

East of England: Up 21%

-

North West: Up 20%

The common denominator? High-value, asset-intensive industries. Aerospace, defence, and automotive are playing major roles in this recovery, and as these sectors scale, they require significant capital investment in plant and machinery.

This has led to a clear shift in asset demand:

-

Increased appetite for specialist machinery (e.g. CNCs, tooling, testing equipment)

-

Growing interest in used assets for fast deployment or to support scaling

-

Need for accurate, regionally relevant valuations that reflect market movement

Businesses are seeking agile solutions; buying, leasing, or repurposing assets with a sharper eye on both operational impact and resale potential.

Aerospace & Automotive: Key Sectors for Leasing & Resale Activity

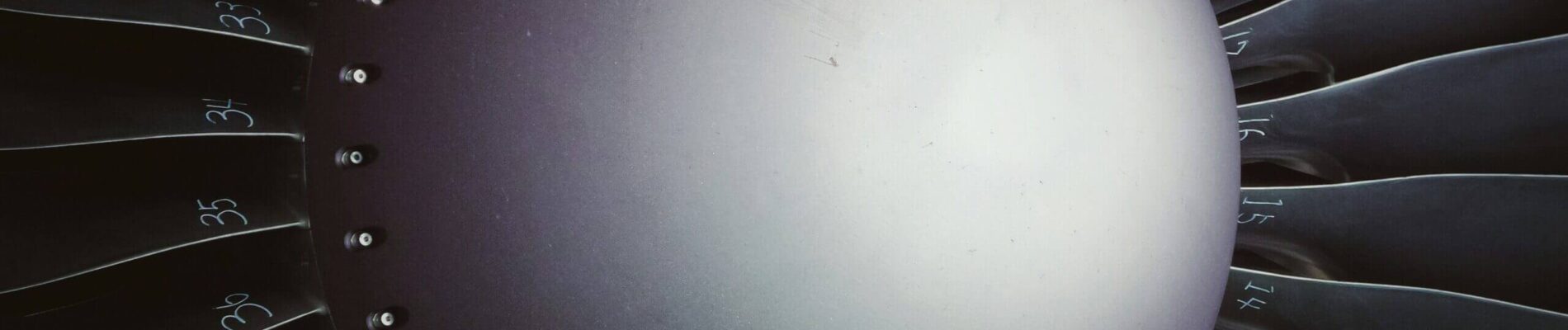

The aerospace and defence sectors are booming in the South West and North West, accounting for over 25% of output in both regions. The rise in large aircraft orders and increased defence spending across Europe is generating long-term confidence—and long-term asset needs.

Meanwhile, automotive production is rebounding in the North West. Manufacturers are investing heavily in new production lines and EV technologies, creating a wave of asset turnover as older equipment is phased out.

This has direct implications for leasing and resale strategies:

-

Manufacturers are turning to leasing to scale quickly without heavy upfront CAPEX

-

Surplus assets are entering the market earlier in the lifecycle

-

Demand for resale-ready, high-spec machinery is on the rise

We’re working with businesses across these sectors to maximise recovery on leased and surplus assets, ensuring equipment is efficiently valued, marketed and sold into regions where demand is high.

How Asset Strategy Is Evolving Nationwide

Across the UK, manufacturers are treating assets less as fixed costs and more as strategic tools. We’re seeing a notable shift in how businesses approach the full asset lifecycle:

-

Valuation: With so much capital tied up in machinery, up-to-date valuations are critical—for everything from refinancing to M&A due diligence.

-

Lifecycle Planning: Businesses are investing in forward-looking strategies that map out acquisition, maintenance, and disposal timelines to maximise ROI.

-

Redeployment & Resale: Internal redeployment is becoming more structured, while external resale strategies are focused on speed, compliance, and value recovery.

Why This Matters Now

With UK manufacturing on the rise and key sectors accelerating, the businesses that succeed will be those that treat asset intelligence as core to their operations, not a reactive task at the end of a lease. Forward-thinking businesses are instead integrating asset strategy into their broader operational and financial planning. They’re using data to understand the real-time value, condition, and potential of their machinery and equipment, not just when a lease ends or an asset becomes surplus, but throughout its entire lifecycle.

This enables smarter decision-making, including:

-

Strategic investment in upgrades or replacements based on accurate depreciation models

-

Faster redeployment of underutilised assets across different sites or divisions

-

Optimised timing for resale, capturing higher market value while demand is strong

-

Improved forecasting and budgeting, based on a clear understanding of asset condition and lifespan

In short, asset intelligence is becoming a competitive advantage, especially in capital-intensive industries like aerospace, defence, and automotive where equipment is highly specialised and investment cycles are long. This is the moment to move from reactive asset management to proactive asset intelligence.

At Hickman Shearer, we help businesses across the UK put asset strategy at the heart of their operations, supporting smarter decisions, stronger returns, and future-ready resilience.

About Hickman Shearer

At Hickman Shearer, we specialise in delivering exceptional RICS and ASA certified capital asset valuation, management, and sales services. Our expertise span a wide range of global industries, ensuring that we provide tailored and insightful commercial valuations and equipment valuation services to meet your unique needs. With a strong track record of delivering robust and independent advice, we are committed to supporting businesses in achieving their strategic objectives. Find out more here >> About Us

Sign up to our Industry Insights Newsletter to stay up to date with the latest industry updates >> Subscribe

Follow our developments on Linkedin: Follow Us